Why 90% of Traders Fail in January (And How You Won't)

Category: Trading Psychology & Strategy

We all know the feeling. It’s January 2nd, the charts are open, and you have a fresh journal that says "This is my year." You are ready to crush the markets.

But statistically, January is one of the most dangerous months for retail traders.

While everyone is rushing to make back their holiday spending, the institutions (the "Big Players") are still slowly returning to their desks. If you aren't careful, you’ll blow your account before February even starts.

Here is why most traders fail in January—and exactly how you can trade differently.

1. The "Santa Rally" Hangover

In December, we often see strong trends (the "Santa Rally") or very low volume. New traders assume January will immediately continue those trends. It rarely does.

January is often a month of market recalibration. Hedge funds and banks are rebalancing portfolios. This creates "choppy" price action—lots of fake-outs and wicks.

The Trap: You see Gold breaking a high, you buy, and suddenly it reverses 50 pips.

The Fix: Wait for the second confirmation. As scalpers, we love volatility, but in early January, erratic volatility is a dangerously quick way to hit a Stop Loss.

2. The Liquidity Vacuum (Watch Your Spreads)

Even though the markets are "open," liquidity doesn't fully return until the second week of January.

If you trade NAS100 or Gold, you might notice wider spreads or "slippage" during news events.

My Advice: If you normally risk 2% per trade, drop it to 0.5% or 1% until January 15th. Protect your capital while the market wakes up.

3. The "Revenge Trading" of the New Year

Many traders overspent in December. They come to the charts in January with a subconscious need to "make money fast" to pay off credit cards.

The Reality: The market does not care about your bills.

When you trade from a place of need rather than strategy, you force trades that aren't there. You ignore your trading plan because you "need" a win.

The Fix: Read my book, "Beyond the Charts: From Fear to Fortune." I wrote it specifically for this mindset shift. You must separate your financial needs from your chart analysis.

4. Ignoring the Fundamentals

January sets the tone for the economic year. You cannot just look at the 5-minute chart; you have to know what the Federal Reserve or the Central Banks are planning for the year.

Are they cutting rates?

Is inflation rising?

These narratives start in January. If you are scalping NZDJPY, you need to know what the Bank of Japan is saying this month.

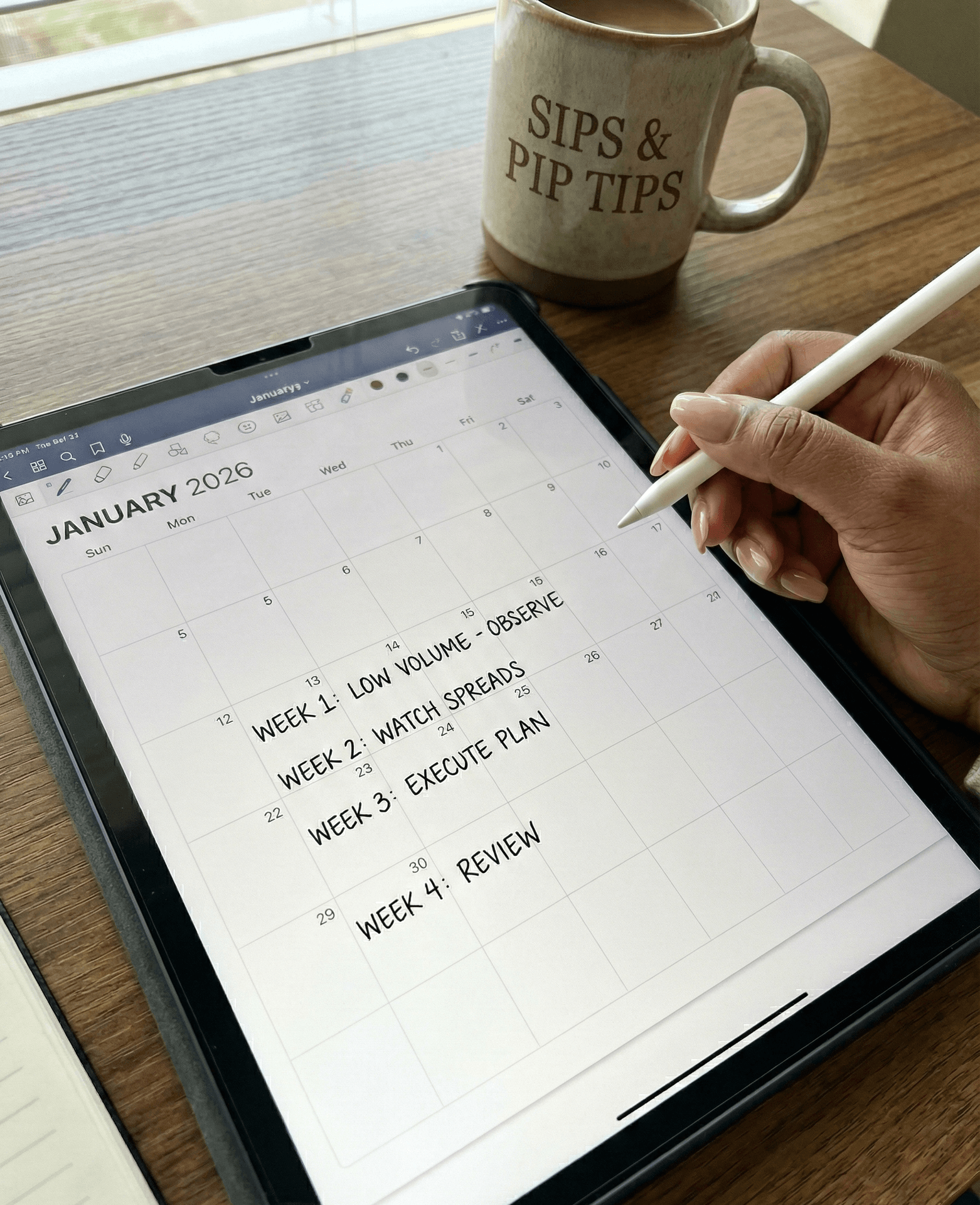

Your January Game Plan

Don’t try to make a million dollars in Week 1. Use January to build your structure.

Survive Week 1: Trade small size (0.5% risk).

Observe Week 2: Watch for the real trends to establish themselves.

Attack Week 3: Once volume is back, execute your strategy with confidence.

Conclusion

2026 is going to be your best year, not because you traded more, but because you traded smarter. Let the 90% rush in and lose their money. We will wait, watch, and strike when the setup is perfect.

— Mellissa Stamboul | Forex Business Coach