Stop Getting "Wicked" Out 🕯️

Category: Technical Strategy

Grab your cup ☕—today we are getting technical.

If you have been trading for any length of time, you know the feeling. You spot a perfect breakout forming. The candle is pushing hard through a resistance level. The momentum looks unstoppable.

The Fear Of Missing Out (FOMO) kicks in. You hit "Buy."

And then... disaster.

The candle suddenly shrinks, leaving a long wick behind. The price reverses, hits your stop loss, and you are left staring at a "False Breakout" (or a "Fake-out"). You just got wicked out.

It is one of the most frustrating ways to lose a trade, but it is also one of the easiest to fix if you change your mindset.

The "Sip" Strategy: The Power of Waiting

This is where the "Sip" in Sips & Pip Tips comes into play.

In trading, your coffee (or tea) is actually a tool for patience. The biggest mistake traders make with breakouts is entering during the candle formation.

The Golden Rule: A breakout isn't real until the candle closes.

When you see price rushing through a level, do not click the mouse. Take a sip. Wait for that candle to close. If it closes back below the level, you just saved yourself a loss.

The "Pip" Tip: The Break and Retest

To drastically increase your win rate and catch high-probability pips, stop chasing the initial breakout. Instead, wait for the Break and Retest.

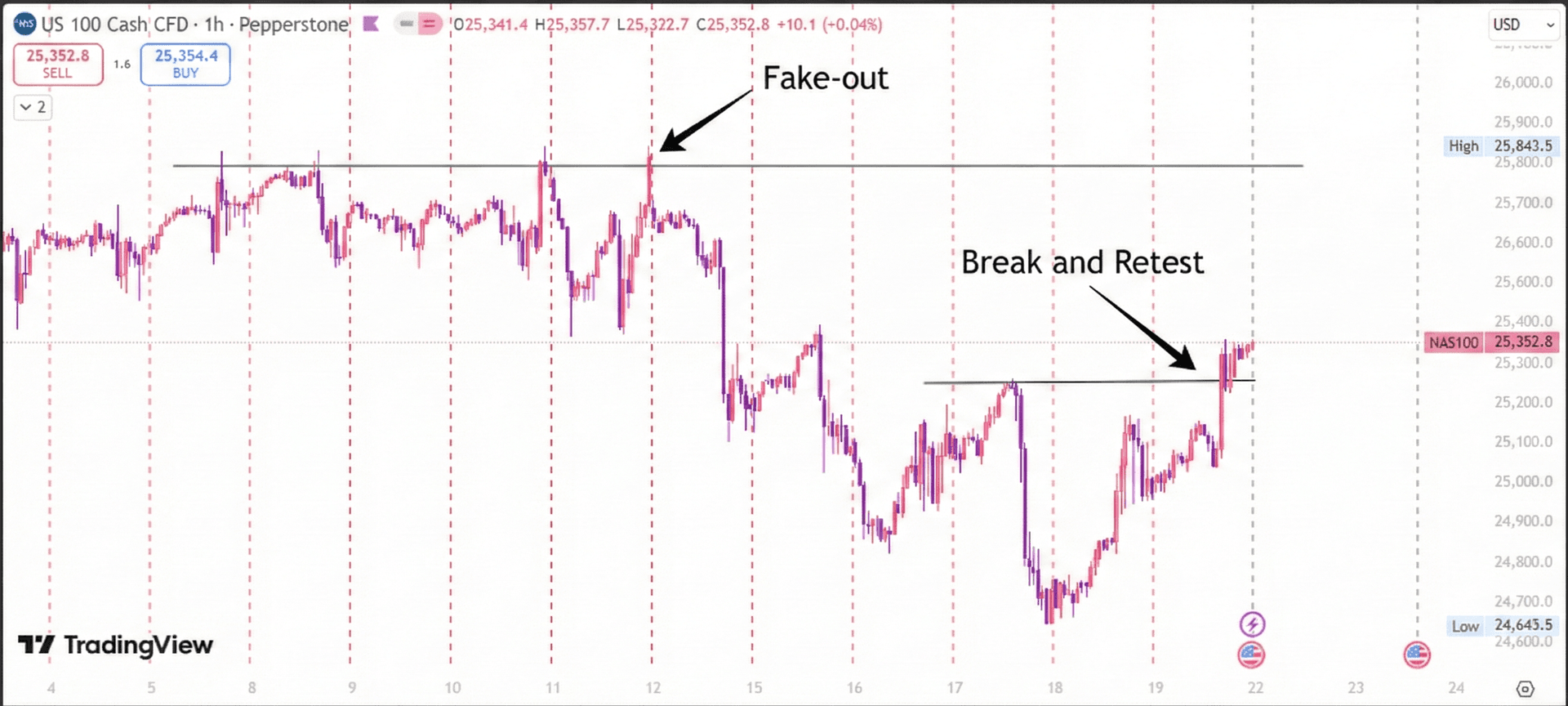

Take a look at this recent NAS100 chart. You can clearly see the difference between a trap and a valid entry:

1. The Fake-out (Left): Notice how the price poked above the resistance line but couldn't hold it? That long wick sticking up was a warning sign. If you entered on the break without waiting, you got trapped in a fake-out.

2. The Break & Retest (Right): See how the price finally broke the level with conviction? But the real magic happened next: price came back down to "kiss" that level. It used the old roof as a new floor. That bounce was your confirmation and your safe entry signal.

Why this works

Institutions often push price through a level to grab liquidity (stops) before reversing. By waiting for the retest, you are confirming that the buyers have truly taken control and are defending the new price level.

You might miss a few runaway trains that never look back, but you will stop losing money on traps.

Sip on that thought while you watch the charts this week!

— Mellissa Stamboul | Forex Business Coach